Not all evergreen funds are created equal. As these funds grow more popular, managers may fall prey to what we see as the “Seven Sins” of evergreen investing, including excessive fundraising, improper use of leverage and more. Read further to explore what each of these sins are and the best practices investors should check for when selecting a manager.

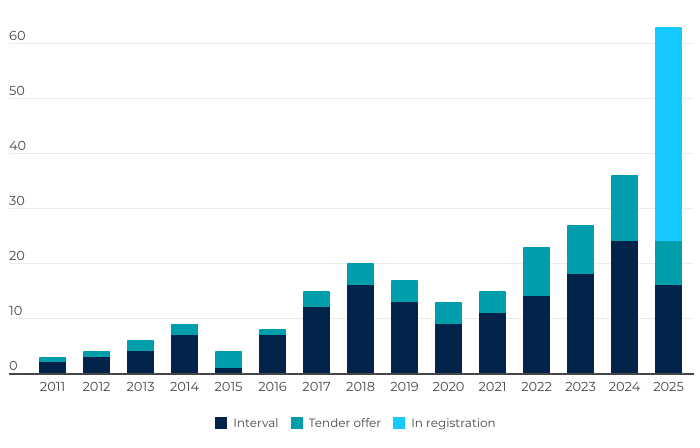

Evergreen funds continue to proliferate across the market, attracting both institutional and wealth investors and fueling more than 60 new funds launched or in registration this year alone.

Yet, this growth creates a more crowded landscape for manager selection. With no traditional evaluation tools like widely accepted standardized benchmarks to help investors, thoughtful due diligence has never been more essential. Recent data highlights significant performance dispersion among evergreen funds, with one-year returns varying by as much as 11% between top and bottom decile managers.

To help investors navigate these complexities, we’ve compiled several common pitfalls of managers: the “Seven Sins” of evergreen portfolio management. While the metaphor is playful, the risks are real and demand careful attention.

1. Greed: Excessive Fundraising

Some may have the temptation to raise capital rapidly and outpace a manager’s ability to deploy funds effectively. In evergreen structures, managers are incentivized to grow assets under management, often charging fees on net asset value (NAV). Unlike traditional private equity funds, evergreen managers cannot control the timing of investor subscriptions, making fundraising discipline a critical skill.

Best Practice: Develop a conservative, well-considered fundraising plan that aligns with organic cash generation, expected distributions, deal flow velocity, and forecasted redemption activity. Capacity targets should be tailored for each fund, with a focus on sustainable growth rather than scale for its own sake.

2. Sloth: Inefficient Deployment and Cash Drag

Slow or inconsistent deal flow can lead to cash drag, diluting portfolio returns. Achieving and maintaining full investment is vital.

Best Practice: Build a diversified pipeline and maintain high deal velocity. Managers should resist the temptation to ease underwriting standards as funds grow. Instead, they should uphold rigorous criteria consistent with flagship drawdown programs, ensuring capital is deployed efficiently without compromising quality.

3. Envy: Chasing Secondary Discounts

Recent headlines have spotlighted the role of secondary discounts in evergreen fund performance. While acquiring assets at a discount can boost short-term returns, this approach is inherently procyclical, expanding during market stress and contracting during optimism, making reliance on them risky. Furthermore, excessive exposure to mature, tail end assets can limit go-forward appreciation potential.

Best Practice: Investors should scrutinize the quality of discounted assets, recognizing that some may be low quality or past their prime. A more durable strategy focuses on assets with long-term appreciation potential, even if discounts are smaller. Diversification across younger, higher-quality portfolios may enhance resilience and has the potential to deliver more consistent returns.

4. Wrath: Improper Use of Leverage

Leverage, particularly through fund-level credit facilities, can be a useful tool when managed prudently. However, drawing on credit facilities to meet routine operational needs or support redemptions introduces significant risk and cost. Liquidity tends to dry up during market stress, and overreliance on credit facilities can leave funds exposed during crises.

Best Practice: Managers should treat credit facilities as an insurance policy, sizing them appropriately and stress-testing their use during adverse market conditions.

5. Lust: Valuation Distortion

Evergreen funds require frequent NAV calculations, often within tight timeframes. Accurate NAV estimates are crucial, as they directly impact investor transactions. However, in the absence of readily observable market prices for some assets, valuations carry the risk of being overly optimistic to support performance.

Best Practice: Implement independent oversight of valuation policies, whether through third-party providers, internal teams separate from investment decision-makers, or a hybrid approach. Key considerations include repeatable and independent frameworks for adjusting valuations, regular review and documentation of decisions, and alignment with investors through robust governance.

6. Gluttony: Inadequate Diversification

Quantitative analysis consistently shows that thoughtful diversification is the most effective way to achieve attractive risk-adjusted outcomes in private markets. Concentration risk with overexposure to a single type of deal or source of deal flow can undermine portfolio resilience.

Best Practice: True diversification should span multiple factors, including but not limited to, region, sector, industry, company size, and investment year, tailored to the fund’s mandate. Not all managers are equipped to deliver the necessary breadth and velocity of deal flow. Multi-manager approaches are advantageous as they have access to diverse opportunities.

7. Pride: Overconfidence in Fund Management

Overconfidence is the silent killer of evergreen performance. Liquidity forecasts, redemption pacing, and cash-flow timing rarely behave as modeled – especially in stressed markets.

Best Practice: Build humility into forecasting. Use scenario analysis, Monte Carlo simulations, and stress testing to capture tail-risk dynamics. The central risk for evergreen funds is liquidity, so establish institutionalized portfolio management teams that continuously update assumptions and track liquidity coverage ratios.

Don’t Get Caught in the Shadows

Evergreen funds offer compelling access to private markets, but their unique structure demands careful design and disciplined execution. The “Seven Sins” outlined above are not theoretical – they manifest in real portfolios and can erode performance and trust if left unchecked.

Best practices in fundraising, deployment, asset selection, leverage, valuation, diversification, and fund management serve as guardrails. By paying careful attention to which managers do and do not have these practices, investors can pursue evergreens’ significant potential with greater confidence.

HarbourVest’s evergreen strategies are fueled by highly selective deal flow sourced from more than 650 managers worldwide and a data-driven, disciplined investment approach managed by a dedicated team. We apply our four decades of experience in private markets to design solutions that work hard at the core of your portfolio, across market cycles and investment styles.