Today, CVCA announced the winners of the second Canadian Women in Private Capital Awards, which recognize the exceptional contributions of women in the Canadian private capital industry. These awards celebrate the achievements of women who have demonstrated a dedication to professional excellence, raised the bar for performance, and contributed significantly to improving diversity in the industry and beyond.

This morning, CIBC Innovation sponsored a reception event to honour the exceptional contributions of women in the Canadian private capital industry. At the event, the award winners shared their valuable perspectives on the progress made toward equity in the VC and PE ecosystem. Here are some highlights from their insightful discussions.

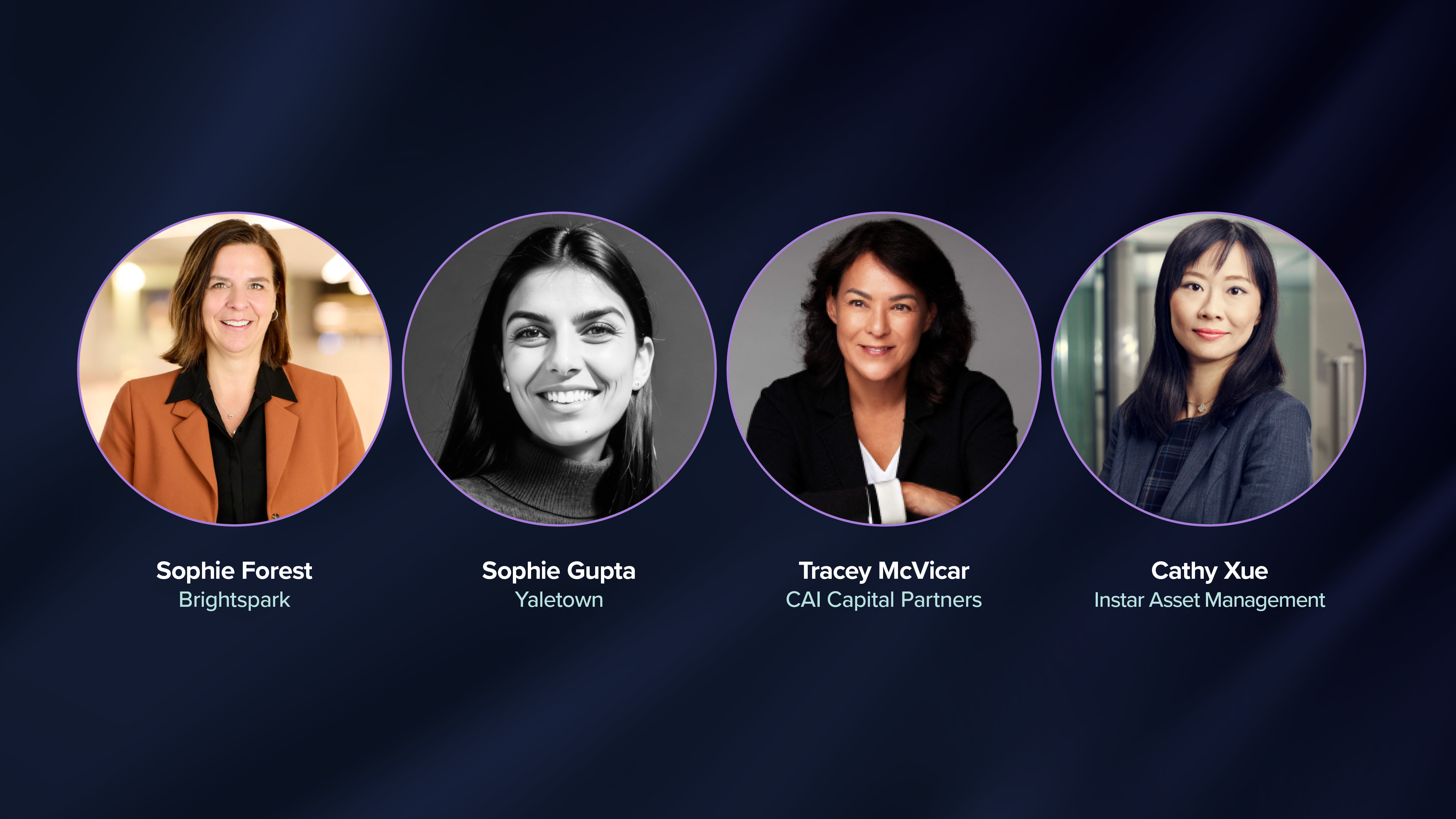

Tracey McVicar, Partner, CAI Capital Partners — 2024 Woman of Achievement Award Recipient (PE)

What do you see as some of the most significant progress that has been made in terms of equity in the VC and PE ecosystem in recent years?

I see more diversity in both GPs and LPs at private equity firms, and also at our service partners (lawyers, accountants, investment banks, etc.). I’ve watched more and more women progress through the ranks and firms seem to be getting better at retaining them through later stages of their careers. Of course, the pace of change feels glacial at times, but there is a marked difference in meetings and on screens today compared to ten or 15 years ago. By far the best developments in the current cycle have been watching trailblazers like Lisa Melchoir at Vertu and Maria Pacella at Penderfund raise their own funds as principals and leaders!

What would you say to women and underrepresented groups to encourage considering a career in venture capital and private equity?

Diverse founders and management teams need you! You have a unique perspective and value to bring to the VC and PE industry and that translates into impact with a huge potential multiplier effect. If you love business, finance, and helping others, our industry offers the chance to experience investing from deal sourcing to exit – with a lot of interesting and fulfilling roads to travel along the way.

What do you envision as the future of diversity, equity, and inclusion in the overall business community and society, and what actions do you believe can be taken by individuals and organizations to drive this progress forward?

The business case for DEI is proven – diverse perspectives add value to investment decisions. Any business model that fails to embrace over 50% of human capital is destined to be sidelined by its more rational competitors. I believe these facts, and continued efforts to educate leaders at all levels will result in DEI being organic within organizations, rather than being imposed by regulation or otherwise.

Sophie Forest, Managing Partner, Brightspark Ventures – 2024 Woman of Achievement Award Recipient (VC)

What do you see as some of the most significant progress that has been made in terms of equity in the VC and PE ecosystem in recent years?

Young, smart women are now becoming an intrinsic part of the VC ecosystem and most firms are now respecting and valuing the journey of each team member, placing importance on maintaining a healthy work-life balance. This trend is new and evolving.

What would you say to women and underrepresented groups to encourage considering a career in venture capital and private equity?

It is the most fascinating industry. You get to work with diverse founders driven by passion and wanting to change the world. The VC industry is constantly evolving and becoming more diverse. Given your role in making decisions on risky investments with significant uncertainty, it is essential to include diversity in the decision-making process.

What do you envision as the future of diversity, equity, and inclusion in the overall business community and society, and what actions do you believe can be taken by individuals and organizations to drive this progress forward?

Culture shifts will significantly influence businesses to incorporate diversity as a core value. Companies will be required to incorporate concrete applications such as respect for parental needs and diverse decisions amongst teams for better outcomes.

Cathy Xue, Principal, Instar Asset Management Inc. – 2024 Rising Woman Star Award Recipient (PE)

What do you see as some of the most significant progress that has been made in terms of equity in the VC and PE ecosystem in recent years?

While progress has been made, there remains significant room for improvement in diversity, equity and inclusion in PE.

More broadly, the professional and financial lives of women across the world were disproportionately affected by COVID-19, with the World Economic Forum estimating that on our current trajectory, it will now take 132 years to close the gender gap worldwide, which is effectively a generation longer than the 100 years it was pre-pandemic.

The current reality is that fewer women work in private equity than in any other area of the financial sector, accounting for about 22% of total private equity employees and just 13% of senior employees, according to a study by Preqin in March 2023. Women also tend to be underrepresented in the leadership ranks of the companies that receive private capital.

Private equity is a significant source of growth for small and mid-sized enterprises, with middle-market deals typically representing about 50% to 60% of all U.S. private equity activity. For me, that means that our industry has the opportunity — and the responsibility — to promote diversity and inclusion in the overall business community.

I started my career in investment banking in New York, where I was the only woman on a team of 60 people. Ten years ago, I joined Instar Asset Management, a middle-market private equity firm focused on investing in businesses that provide essential products and solutions across North America. At Instar, we have made consistent efforts at embracing and accelerating DEI. Currently, both our executive leadership team and the overall team are 50% female.

Efforts by organizations such as the CVCA and Women in Capital Markets (WCM) are making a positive impact on DEI in PE. I was fortunate to participate in WCM’s Emerging Leaders Program and benefited from the executive coaching and networking opportunities, not to mention the friends I made through the program. Today, I host a circle of middle-level women in private equity, where we share our experiences and challenges, and encourage each other to be our best selves at work.

What would you say to women and underrepresented groups to encourage considering a career in venture capital and private equity?

I think a career in private equity is very rewarding. A key motivation for me to pursue a career in private equity is the people and the ability to make an impact. We are fortunate to work with some of the smartest and most driven people in this industry. At a young age, we have the opportunity to work with senior executives at businesses, and effect changes and drive value at the Board level.

Such opportunities also come with their challenges. Like many other women in this room, I am sometimes the only woman at Board meetings. Having a voice and developing the ability to influence at the senior executive level is an area I continue to develop. What I found is there are no shortcuts, it takes time and hard work to gain the trust of the people we work with. My personal experience is that sometimes I feel a need to change in a certain way to make it easier to fit in. Over the long term, I’ve realized that it’s ok to be my authentic self. I keep being pleasantly surprised at how I can develop relationships and friendships with people who might see me as being different – it all comes down to the trust you build by working together and accomplishing common goals.

What do you envision as the future of diversity, equity, and inclusion in the overall business community and society, and what actions do you believe can be taken by individuals and organizations to drive this progress forward?

As Ruth Bader Ginsburg said: women belong in all the places where decisions are being made.

One of the areas that we’ve focused on at Instar is removing diversity-related barriers to recruitment. The way we put forward job descriptions might affect the candidates who apply. In our day-to-day jobs, I think it’s important to encourage people to bring their authentic selves to work. At a personal level, being authentic drives diversity. On an organizational level, the promotion of diversity, equity and inclusion is not just an HR matter. I attend a lot of women’s events where we talk about how we can promote diversity in the industry. Sometimes I wonder if we are missing the point – our audience of these discussions should not be just ourselves – but all the other decision-makers of the industry.

I think mentorship is important in promoting diversity, equity and inclusion. You can’t be what you can’t see. I’m fortunate to have the guidance and support of senior women both within and outside of my organization throughout my career. It is likewise important for me to spend time supporting younger women in the industry. I think diversity, equity and inclusion comes from support and respect for each other.

Sophie Gupta, Principal & Head of Responsible Investing, Yaletown Partners — 2024 Rising Woman Star Award Recipient (VC)

What do you see as some of the most significant progress that has been made in terms of equity in the VC and PE ecosystem in recent years?

A number of things come to mind. First, is the growing movement of investors seeking to create impact and the increased recognition that capital markets must evolve to include stronger standards of DEI success alongside, and as a precursor of, financial return. Companies and funds alike are under extraordinary pressure to maintain financial performance while navigating an ever-rapidly changing business landscape, while also creating an internal culture of transparency and inclusion and transforming operations to meet social-impact expectations. And while gains in progress as a whole have been lumpy, they are directionally positive with the biggest win being that it is increasingly understood that more equitable practices and financial returns are only not mutually exclusive but that there is a strong, positive correlation between them. Second, we’ve seen significant strides in the heightened awareness of the existing diversity gaps, both within VC/PE firms and portfolio companies, prompting the industry to take steps to actively address and rectify these imbalances. Many firms have responded by implementing dedicated initiatives aimed at creating more inclusive and representative workplaces and we’ve seen the emergence of greater number of funds specifically designed to support underrepresented founders, helping to close the funding disparities that have long persisted in the industry.

What would you say to women and underrepresented groups to encourage considering a career in venture capital and private equity?

I would say that I know all too well just how daunting access to this profession can seem at first, but not to let that deter you. This wild and sometimes seemingly obscure industry makes for incredibly fulfilling career opportunities – a Ven diagram of sorts across entrepreneurship and innovation, finance, strategy and, perhaps most importantly, relationships. The world of VC/PE is dynamic, multifaceted, and ever-evolving and there is a tremendous need for bright and creative minds with diverse backgrounds and life experiences to help shape its future. I’d say too that the effort it takes to navigate getting here is not only worth it, but that the journey will widen your perspective and broaden your skill set, making you an even better investor. Career paths are never linear: the most interesting people I know have had the most peculiar gigs before they started in VC. Write your own story and do so with thing you’re passionate about.

What do you envision as the future of diversity, equity, and inclusion in the overall business community and society, and what actions do you believe can be taken by individuals and organizations to drive this progress forward?

Of course, I would love for us to live and work in a world where all people are celebrated, treated equitably, and made to feel safe and included. While that may be a rather grand and lofty vision, I do envision a culture where DEI is truly understood and widely accepted as being integral to business success. Cultivating that culture will require an unwavering commitment to continuous advocacy for systems-level change. It will require leadership across all organizational levels, the implementation of comprehensive training programs, a deeper recognition of biases and a much more nuanced understanding of intersectionality.

Unquestionably, there has been an accelerated pace of this cultivation in recent years, but there is still much to do. Strategies for transformation in our industry need to stem beyond public commitments to DEI and embed their way into values and firm philosophy. At Yaletown, more than 60% of our people identify as being racialized or ethnically diverse and more than 60% identify as women. We did not wake up that way accidentally. It is a reflection of belief systems and the work done to prioritize them over the firm’s two-decade-long history.

As important as this work is within organizations, as is the case with all forms of systemic change, the only way to be successful is to address root causes across systems. This will require greater collaborative efforts among individuals, organizations, and societal structures. And in my view, only further underscores the terrific need for the leadership of advocacy and convening bodies, like the CVCA, to facilitate and enable those crucial cross-industry collaborations.